Now that the lockdown restrictions are slowly beginning to lift, you may find yourself looking for ways to make changes to your living situation. If downsizing for retirement is on your mind, this in-depth guide will help you stay organized while you declutter before moving to your forever home.

And, if you’re wondering where to start—we’re here to help! We’ll run through a few hints and tips on how to downsize effectively and get ready for retirement.

1. Sort your items

SOURCE: PEXELS

Whether you’re downsizing, moving, or simply want to get rid of extra items—sorting and organizing your stuff will help you towards your path to retirement.

Therefore, before taking any further steps make sure to go through your stuff and literally ‘downsize’ the number of things you own. You probably have a lot of stuff that you don’t need—the average American household has 300,000 things. It sounds overwhelming but it doesn’t have to be. Turn it into a fun game by dividing it into three piles—discard, donate or sell.

2. Declutter to downsize

Here’s how you can declutter your cosets, drawers and downsize everything you own.

+ Go through one item at a time:

Yes, it might take a while but at the end of it you’ll be sure you gave each item a thought. Take each item and in Kondo-style determine if it “sparks joy” if it doesn’t you know which designated pile it belongs in.

+ Take your memories digital:

Some items carry an emotional connection and you don’t want to discard them. For example–it can be hard to part with your child’s first sports award. Scan each sentimental item, picture or artwork and send the hardcopy to a storage unit. A great, full-service storage solution like MakeSpace will pick up your stuff, store it and bring it back when you need it—all for an affordable price.

+Make it a family activity:

One weekend invite your kids over and have them take furniture or miscellaneous items of their choosing. The dining set that’s been in the family can now turn into your very own family heirloom. Take the opportunity to give away items. You’ll not only have more space but the joy of giving items to your loved ones is quite invaluable.

+Don’t be afraid to sell some items:

Host a garage sale for items in good condition that you no longer need.

Post on your community’s social networks, distribute flyers in your neighborhood and tell friends and family to spread the word. You can make quick cash on furniture and home goods to contribute towards your retirement funds.

+Donate the leftover items:

Bring items to a donation center that you care about like your local soup kitchen or Goodwill. Goodwill places items they can’t sell into a “salvage stream”. Through this stream, they try to sell items to the textile industry or other recyclers.

3. Think about storage

Once you’ve decluttered, donated and downsized—use innovative storage solutions to organize your belongings, free up space and, on the whole, keep your place tidier.

Your choice of storage will depend on your needs. You could use a vacuum-packed storage bag, get an ottoman or invest in a full-service storage solution like MakeSpace. Keeping any unwanted belongings out of sight and out of mind will make your home look and feel a lot more comfortable.

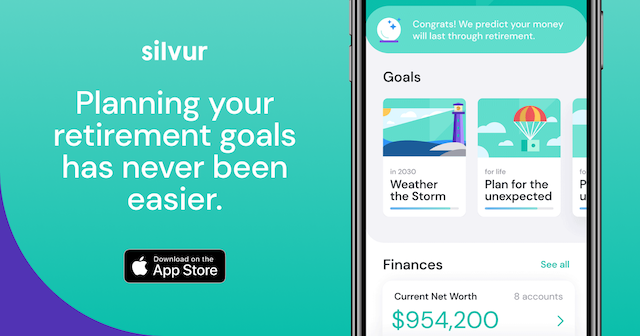

4. Invest in tech

Downsizing or decluttering your home is all about making it more manageable to live in—keeping you comfortable, stress-free and able to enjoy your retirement in the best way possible. Technology can be your best friend. From investing in a robot vacuum cleaner to downloading Silvur—a free retirement planning app that helps calculate your retirement plan and income. These resources are solely designed to make your life and retirement planning easier.

Silvur can help guide you through life decisions with Silvur’s retirement checklist and calculators. Whether figuring out if you should downsize or refinance, Silvur projects your Retirement Score to show your monthly expenses against your income. Your Retirement Score shows you how long your money will last. The score even shows your estimated Social Security benefits and Medicare costs! Where you live in retirement can also impact your savings such as Medicare costs and taxes—Silvur will help you calculate your finances to make better decisions.

5. Finding the right place

Do you feel that you can maintain your current home—both financially and physically—in your later years? If the answer is no, you should probably consider downsizing to a manageable property. If you’re unsure, try to declutter rooms and see if there’s more space than you need.

There’s also a lot of financial calculations to consider as well. If you plan to downsize once you retire, there can be some hurdles for receiving a mortgage with no income. However, there are things you can do now to help with the mortgage process or maybe you can start searching before you retire.

Knowing the answers to these questions will ultimately make downsizing much easier.

6. Things to look for in your retirement home

SOURCE: PEXELS

The following decisions are necessary to choose your next home for retirement:

+Apartments or a smaller single family home:

Apartments and condos offer a simpler lifestyle. But, a single family might seem attractive based on the flexibility of space. Regardless of the home type, make sure your new home is suitable for retirement. Look for things like minimal stairs and a parking space close to the door. Get familiar with your retirement property options to make the best decision.

+Renting versus buying:

Both options have their pros and cons. Renting a home takes away all of the maintenance responsibility. If you want to make updates and walk away with a profit from a resale, you might consider buying. In addition, your home can be your biggest asset in retirement and help you with receiving loans or income.

+Weather and accessibility:

If you plan to downsize into a new city, get to know the area before you commit to your next home. The proximity of your new home has more of an effect on your decision now than it did 30 years ago. Look for a home near restaurants, shops, and one that’s in close proximity to your family and friends.

Enjoy the process!

It’s a new phase and a whole new lifestyle. Even if there’s lots to do—enjoy the process and it will automatically be a great new project to execute. Before you know it, you’ll be in your new downsized life and loving every bit of it.